The value of financial advice isn’t always obvious from the get-go. Yet in many cases, the benefits of working with the right financial advisor far exceed the cost.

As your net worth increases, managing the details of your personal finances can become increasingly complex and time-consuming. Not to mention, mistakes can be costly.

Perhaps this is why 95% of people who work with a registered advisor believe it’s worth the money, according to a recent MagnifyMoney survey. Yet despite the potential benefits of professional advice, cost is still one of the top reasons people choose to go it alone.

Indeed, the benefits of working with a financial advisor aren’t always obvious—especially at the outset of the relationship. But before committing to a do-it-yourself approach, be sure to consider the potential value of financial advice.

Quantifying the Value of Financial Advice

The value of financial advice depends on many factors, including your financial advisor, the complexity of your situation, and your financial goals. Still, there’s a growing body of research aimed at quantifying the benefits of sound financial planning.

For example, research from Morningstar shows that “intelligent financial planning decisions” can add the equivalent of 1.59% to a retiree’s annual arithmetic investment returns.

Meanwhile, a variety of other studies focus on the intangible benefits of working with a financial advisor. For instance, 86% of women say that having a professional manage their investments makes life less stressful, according to Fidelity’s 2021 Women and Investing Study.

The Benefits of Working with a Financial Advisor

To be sure, the value of financial advice typically becomes increasingly evident over time. However, the potential benefits of working with a financial advisor often extend beyond quantifiable metrics. In some cases, you may notice the intangible benefits of professional advice first.

Benefit #1: A Financial Advisor Can Help You Maximize Your Wealth

After trustworthiness, a strong investment track record is the main reason clients choose a financial advisor, according to data from Qualtrics. Yet the value of financial advice depends just as much on not losing money as it does on making money.

In other words, many people can get lucky when it comes to picking investments. However, identifying and managing the various risks that accompany these investments requires experience and expertise.

For example, the right financial advisor will help you preserve more of your wealth by avoiding high-cost funds and other investments. Due to the power of compounding, high expenses can eat away at portfolio returns over time. This, in turn, can erase a significant portion of your nest egg.

In addition, annual tax-loss harvesting and portfolio rebalancing can help you protect your financial resources long-term. These strategies can help mitigate unnecessary losses due to capital gains taxes and excess portfolio risk.

Lastly, a financial advisor can help you identify and implement the right estate planning strategies to preserve your assets for generations to come. These strategies may include proper asset titling, asset location, and insurance planning—all of which may be necessary to achieve your long-term financial goals.

Benefit #2: A Financial Advisor Can Help You Avoid Costly Mistakes

Successful investors aim to buy low and sell high. Yet research shows that in practice, the average investor does just the opposite.

This is because humans are hard-wired to make irrational decisions. Often, the value of financial advice is that someone less emotionally tied to your money can help you avoid such costly mistakes.

Consider that the S&P 500 Index generated an annualized return of 10.65% over the last 30 years. Meanwhile, the average equity investor earned an annualized return of just 7.13% over the same period. If you had invested $100,000 at the beginning of the period, that’s a difference of nearly $1.3 million over 30 years.

According to market researcher Dalbar, this disparity can largely be attributed to investors buying and selling at the wrong times. In other words, when left to their own devices, investors tend to buy into greed and sell into fear. This only works against them in the long run.

These mistakes may seem harmless in the moment. But over time, they can mean the difference between achieving your goals and falling short.

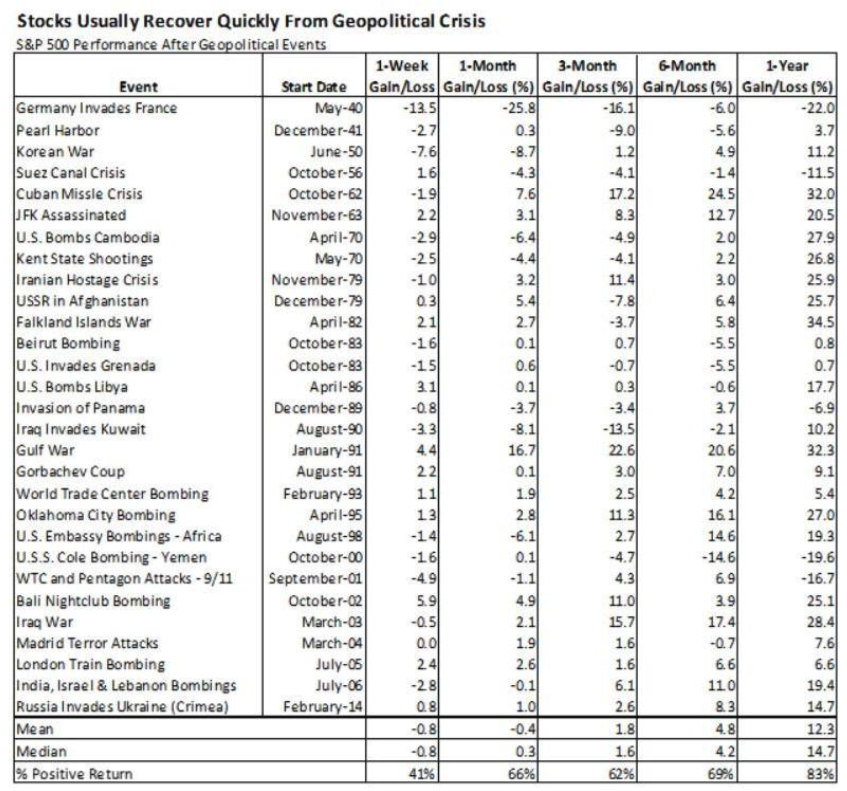

The right financial advisor can help you develop a long-term investment plan and stick to it—especially during periods of discomfort—so emotionally driven decisions don’t erode your nest egg.

Benefit #3: A Financial Advisor Can Save You Time, Energy, and Stress

Lastly, working with a financial advisor can save you time, energy, and useless worry. In some cases, it can even improve your overall happiness level.

According to a recent survey from Herbers & Company, clients who work with a financial advisor tend to be happier than those who don’t. Moreover, happiness levels tend to increase alongside net worth.

Specifically, researchers found that happiness levels significantly improved for financial advisor clients with at least $1.2 million in assets. Based on the study’s findings, this is because higher-net-worth individuals and families are more likely to suffer from decision paralysis.

Ultimately, personal financial management requires time, energy, and expertise. Delegating these decisions to a trusted financial advisor can help you protect your resources, so you can focus on what you love and do best.

For many affluent individuals and families, this is the true value of financial advice.

Benchmark Wealth Management Can Help You Discover the True Value of Financial Advice

As a fiduciary financial advisor, Benchmark Wealth Management provides our clients with holistic financial planning and investment management solutions. We strive to make your life better by offering unmatched client care and attention.

If we can help you develop a long-term financial plan and discover the value of financial advice, please don’t hesitate to get in touch. We’d love to hear from you.

The views expressed are those of the author as of the date noted, are subject to change based on market and other various conditions. Material discussed is meant to provide general information, and it is not to be construed as specific investment, tax, or legal advice

About Rick

Richard W. Stout III is managing director of Benchmark Wealth Management, LLC, with 25 years of experience in the financial industry. He specializes in financial planning and asset management for individuals, families, and institutions seeking to build and monitor durable and sustainable plans for their financial futures. Rick is a Certified Financial Planner™ professional and holds the Accredited Investment Fiduciary® (AIF®) designation. He obtained his MBA from Rensselaer Polytechnic Institute and his BA in Economics and Anthropology from the University of Connecticut. Rick has earned a Master of Science degree in Personal Financial Planning from the College for Financial Planning. He has extensive background experience in lending, credit review and analysis, and real estate and partnership management. Learn more about Rick by connecting with him on LinkedIn.

About Thomas

Thomas J. Britt is managing director of Benchmark Wealth Management, LLC, with 20 years of experience in the financial industry. He specializes in executive financial planning, retirement planning, investing, as well as the management of trusts and endowments. Thomas is a CERTIFIED FINANCIAL PLANNER™ professional. He holds the Master Planner Advanced StudiesSM, MPAS®, Certified Investment Management Analyst® (CIMA®), and Chartered Retirement Planning Counselor℠, CRPC® designations. Thomas earned a Bachelor of Science in Finance from the University of New Haven, an MBA in financial technology from Rensselaer Polytechnic Institute, and a Master of Science in Personal Financial Planning from the College for Financial Planning. He is also a proud veteran of the United States Navy Submarine Force. Learn more about Tom by connecting with him on LinkedIn.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2, available upon request or at the SEC’s Investment Advisor Public Disclosure site, www.adviserinfo.sec.gov/firm/160192

Securities offered by Registered Representatives through Private Client Services, Member FINRA, SIPC in the following states: AZ, CA, CT, FL, KY, MA, ME, MI, MN, NH, NJ, NY, RI, TX. (Securities-related services may not be provided to individuals residing in any state not previously listed.) Advisory services offered through Benchmark Wealth Management, LLC a Registered Investment Advisor. Benchmark Wealth Management and Private Client Services are unaffiliated entities.